How Orlando and Clermont Homeowners Can Profit by Renting Instead of Selling

Orlando and Clermont homeowners considering long-term rentals often hit the same crossroads: cash out now or hold on and earn monthly income. The tension is real, because converting a lived-in home into a rental can bring repair decisions, tenant worries, and time demands that don’t show up in a simple sale. At the same time, the Orlando and Clermont real estate market can reward owners who keep a well-located property and treat it like a business. With the right expectations, long-term rental income can turn an uncertain home value into steadier, repeatable profit.

Quick Summary: Renting for Profit

● Focus on features renters pay more for, like clean layouts, good storage, and functional updates.

● Use a clear tenant screening process to reduce risk and protect your income.

● Make must-do repairs first, then boost curb appeal with simple landscaping and exterior touch-ups.

● Choose between self-management and a property manager based on time, skills, and stress tolerance.

● Learn the legal basics for long-term rentals, including leases, deposits, and required disclosures.

Make Your Home Rent-Ready: A Practical Fix-Up Checklist

The goal is simple: make your home feel safe, clean, and easy to maintain so you can attract solid tenants, reduce emergency calls, and protect your cash flow.

- Start with the “no-surprises” safety sweep: Walk the home like a tenant would, then fix anything that could become a complaint or a liability. Test every smoke/CO detector, replace burnt-out bulbs, tighten loose handrails, and address trip hazards like lifted pavers or uneven thresholds. Confirm locks work smoothly on every exterior door and that windows open, close, and latch properly.

- Handle rental-ready repairs that prevent expensive damage: Take care of small issues that turn into big leaks, mold, or appliance replacements. Patch drywall, stop door rubs, fix dripping faucets, recaulk tubs and sinks, and replace worn toilet flappers. If you can, schedule a basic HVAC tune-up and change filters, tenants feel the comfort difference, and you reduce mid-lease breakdowns.

- Add a few “high-ROI” features tenants actually choose: You don’t need luxury finishes; you need practical upgrades that make daily life easier. Bright, neutral paint and durable flooring in high-traffic areas help showings and reduce turnover touch-ups. If budget allows, add simple storage (closet shelving, pantry wire racks) and strong lighting at entries, small conveniences that photograph well and can justify a slightly stronger rent.

- Boost curb appeal with a weekend landscaping reset: First impressions set the tone for how people treat a place. Trim shrubs away from windows, edge the walkway/driveway, pull weeds, refresh mulch, and make sure the house number is clearly visible from the street. A clean, welcoming exterior also attracts tenants who appreciate order, and those are often the ones who report maintenance issues early instead of hiding them.

- Refresh the facade for “move-in ready” photos: You don’t need a full exterior remodel to look updated. Pressure wash siding and sidewalks, touch up peeling trim paint, clean the front door and consider a modern handle set if yours is worn. Replace missing screens and broken blinds, these are low-cost fixes that quietly signal “this home is cared for.”

- Create a simple maintenance checklist and set expectations in writing: Build a one-page schedule for “every month/quarter/season” (filters, pest checks, gutter look-over, water heater flush, smoke detector test) and calendar reminders so it actually happens. Many landlords find that tenants are more likely to renew when a home stays in good shape, which protects your income by reducing vacancy and turn costs. In your lease, spell out maintenance responsibilities so everyone knows who changes filters, who handles yard care, and how fast repairs will be addressed.

If you knock out these fixes in order, safety, damage prevention, tenant-friendly features, then curb appeal, you’ll be in a strong position to decide how hands-on you want to be once the calls, repairs, and renewals start.

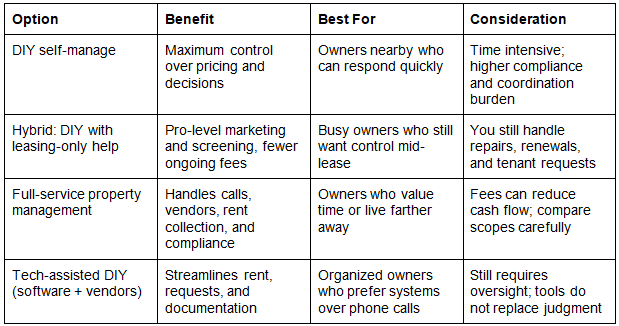

Self-Manage vs Property Manager: Quick Comparison

With the home rent-ready, the next choice is how you will run it day to day. This table compares hands-on landlording versus hiring help, so Orlando and Clermont homeowners can balance time, risk, and income without guessing.

A simple rule: the more time you want back, the more you pay for execution, often with 4-12% of monthly rent as the tradeoff. Choose the setup that protects your schedule first, then optimize income with tighter vacancy control and smoother renewals. Knowing which option fits best makes your next move clear.

Common Rental Conversion Questions, Answered

Q: What are the key features to look for when choosing a home to convert into a long-term rental?

A: Look for a layout that appeals to many renters: practical bedrooms, storage, and easy parking. Prioritize low-maintenance exteriors, durable flooring, and systems with service records, since surprises kill profit. Also confirm HOA rules, lease restrictions, and insurance requirements before you commit.

Q: How can I find and vet trustworthy tenants to avoid rental issues?

A: Use a consistent written screening process: application, ID verification, income and employment checks, references, and a background report. The

majority of landlords use screening technology so it is normal to screen, but keep it fair, legal, and the same for every applicant. If you are unsure, ask a local attorney or experienced agent for a compliant checklist.

Q: What repairs and upgrades should I prioritize before renting out my property?

A: Start with safety and habitability: roof leaks, electrical issues, plumbing, locks, and smoke or CO alarms where required. Then tackle comfort items that reduce emergency calls, like

preventative HVAC system maintenance and servicing aging water heaters. Choose hard-wearing paint and fixtures to limit turnover costs.

Q: Should I manage my rental property myself or hire a property management service?

A: Self-managing can boost cash flow if you can answer requests quickly and document everything. A manager can lower stress by coordinating repairs, compliance, and late payments, which matters if your schedule is tight. Decide based on your time, your comfort with conflict, and how fast you can show up for repairs.

Q: How can a local real estate agent assist me in transitioning my home into a long-term rental?

A: An agent can run rental comps, suggest rent-ready updates that pay back, and help you set a lease timeline that limits vacancy. They can also connect you with vetted vendors and explain common local lease terms and disclosures. Ask for two next steps: a call list of trades you will use first, and a simple template to print contact cards for smoother coordination, including

business card print online options.

Turning Orlando and Clermont Homes Into Steady Rental Income

It’s normal to feel torn between taking the sale proceeds now and worrying a long-term rental will be too much to manage. The steadier path is a simple landlord mindset: treat the home like a small business, run the numbers, and lean on repeatable systems instead of guesswork. When that approach is in place, the advantages of long-term rentals show up in calmer cash flow, fewer surprises, and rental property income stability that makes holding the home feel doable. Renting isn’t about doing everything yourself, it’s about setting up a plan that works every month. Pick one next step today: confirm the rental’s income potential, schedule the most important repairs, or decide whether self-managing or using a property manager fits best. That’s how a first-time landlord turns a homeowner rental journey into long-term resilience and choice.